Direct deposit authorization forms are an essential tool for both employers and employees. They simplify the process of transferring funds from a company to its employees’ bank accounts, ensuring timely and efficient payment. In this post, we will explore the significance of direct deposit authorization forms and provide a comprehensive overview of their benefits, usage, and importance.

Benefits of Direct Deposit Authorization Forms

Direct deposit authorization forms offer numerous advantages for both employers and employees. Let’s take a closer look at some of the key benefits:

1. Time-saving: Direct deposit eliminates the need for manual check preparation, reducing the time and effort involved in payroll processing. It allows employees to access their funds immediately, without the need to visit a bank.

1. Time-saving: Direct deposit eliminates the need for manual check preparation, reducing the time and effort involved in payroll processing. It allows employees to access their funds immediately, without the need to visit a bank.

2. Convenience: With direct deposit, employees no longer need to worry about lost, stolen, or delayed checks. Funds are automatically deposited into their designated bank accounts, providing a convenient and secure method of payment.

3. Accuracy: Direct deposit eliminates the possibility of human errors commonly associated with manual check handling. It ensures that employees receive the correct amount of payment, reducing the likelihood of disputes or discrepancies.

Usage of Direct Deposit Authorization Forms

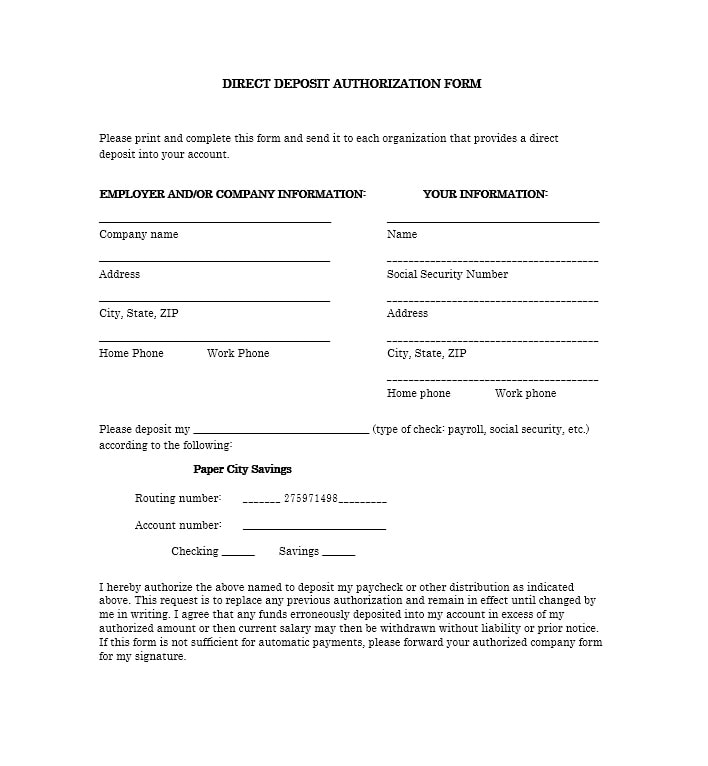

Direct deposit authorization forms are typically used at the onset of an employment relationship or when an employee wishes to update their banking information. These forms collect essential details, such as the employee’s bank account number, routing number, and authorization to deposit funds directly into their account.

The information provided in the direct deposit authorization form is then used by the employer to set up an electronic funds transfer process. This ensures that the employee’s wages are deposited directly into the designated bank account on the agreed-upon payday.

The information provided in the direct deposit authorization form is then used by the employer to set up an electronic funds transfer process. This ensures that the employee’s wages are deposited directly into the designated bank account on the agreed-upon payday.

Direct deposit authorization forms are also commonly used when organizations need to distribute refunds, reimbursements, or any other form of payment directly to an individual’s bank account.

Importance of Direct Deposit Authorization Forms

Direct deposit authorization forms play a crucial role in streamlining payment processes for both employers and employees. Here are key reasons why these forms are important:

1. Security: By eliminating the need for physical checks, direct deposit reduces the risk of lost or stolen payments. The electronic transfer of funds ensures that employees receive their wages securely and directly in their bank accounts.

1. Security: By eliminating the need for physical checks, direct deposit reduces the risk of lost or stolen payments. The electronic transfer of funds ensures that employees receive their wages securely and directly in their bank accounts.

2. Efficiency: Direct deposit simplifies payment processing for employers, allowing for efficient payroll management. It also eliminates the need for manual check distribution and reconciliation, freeing up valuable time and resources.

3. Employee Satisfaction: Offering direct deposit as a payment option can enhance employee satisfaction and retention. It provides a reliable, convenient, and timely method of payment, ensuring that employees have immediate access to their funds.

4. Environmental Impact: Direct deposit reduces the use of paper checks, contributing to environmental sustainability by minimizing paper waste and decreasing the carbon footprint associated with check printing and distribution.

In conclusion, direct deposit authorization forms are an essential tool for organizations seeking to streamline their payment processes and enhance the convenience and security of wage transfers. By offering a direct deposit option, employers can improve efficiency, accuracy, and employee satisfaction while reducing paper waste and environmental impact. It is crucial for both employers and employees to understand the significance of these forms and utilize them to simplify payroll management.